Zero Trust Segmentation protects critical banking systems

Illumio keeps financial services operational

Financial services are critical infrastructure

The deep interdependencies between banks, the local and global economies they serve, and the potential threats instability poses means organizations must deliver services reliably while ensuring they protect customer data, adhere to regulations, and maintain trust.

Why is cybersecurity essential to BFSI?

Protecting customer data

Achieving regulatory compliance

Enabling digital transformation

Disruption is prevalent and costly

- #1

Financial services was the top industry targeted by cybercriminals for five consecutive years of 2016-2020.

- $5.97million

The average cost of a data breach in financial services reached $5.97 million in 2021, 37% higher than the average across other industries.

- 55%

In banking, lost business accounts for 55% of the cost of a breach.

Cyber resilience requires an “assume breach” mindset

The objective of cyber resilience is to maintain the organization’s ability to deliver services continuously. This means doing so even when regular delivery mechanisms have failed, such as during a crisis or after a security breach.

Unlike cybersecurity, which is designed to protect systems, networks, and data from cybercrimes, cyber resilience is designed to prevent systems and networks from being derailed in the event that security is compromised.

Cyber resilience helps businesses to recognize that attackers can be successful in their attempt with the advantage of innovative tools, the element of surprise, and a target — this is the definition of an "assume breach" mindset. This concept helps businesses to prepare, prevent, respond, and successfully recover to the intended secure state.

Challenges to cyber resilience in financial services

- A diverse technology estate makes delivery of consistent security posture a challenge

- Complex processes mean realizing value from new capabilities is often slow

- Regulatory demands often force over-burdening of controls (e.g., PCI-DSS scoping)

- Pressure of accelerating digital transformation leads to an uneasy balance between productivity and security

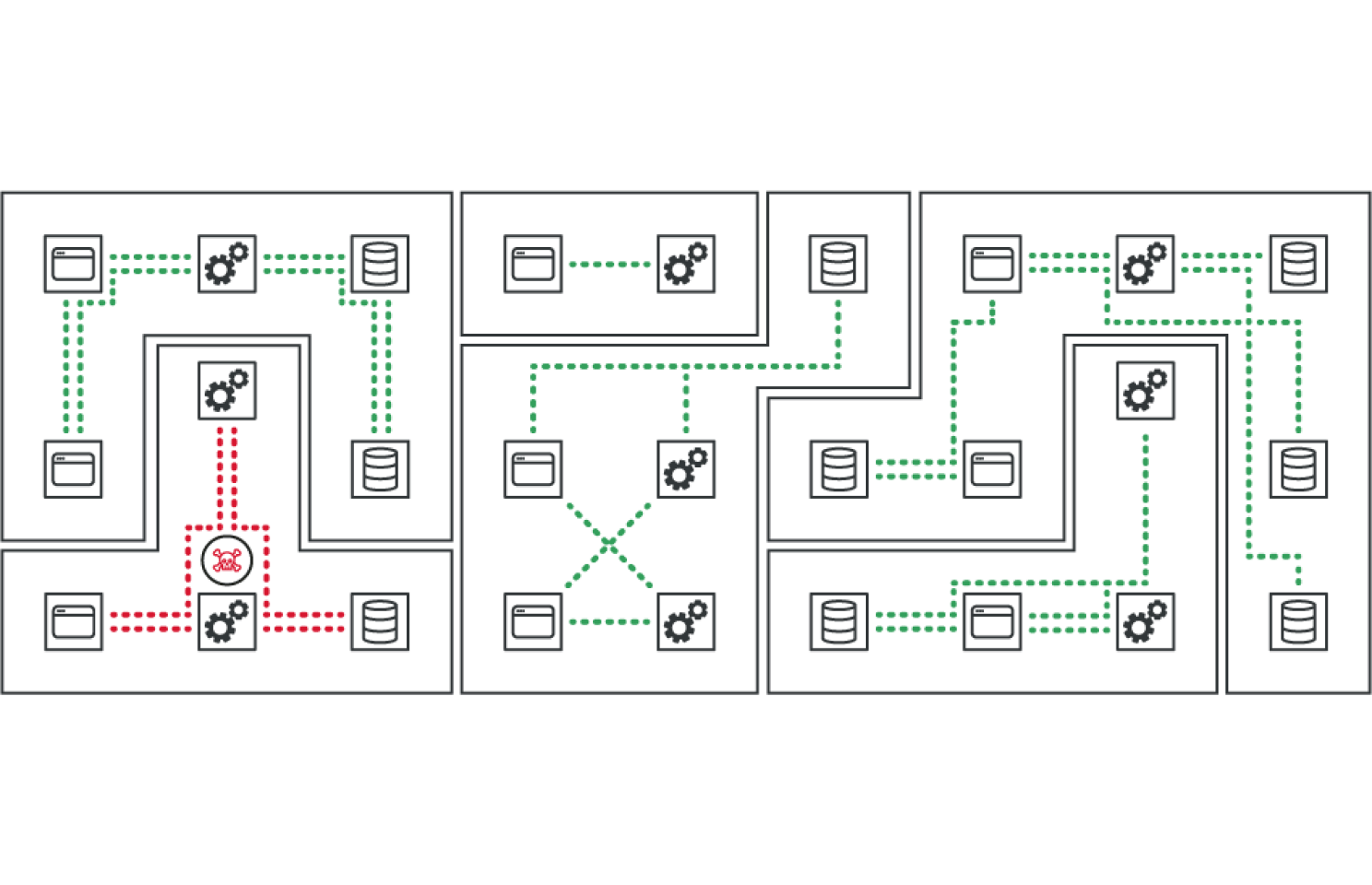

- Banking applications are highly interconnected (both within the bank and with counterparties) and are at increased risk of supply chain attacks

How does Illumio help?

Protect customer data

- Understand all access to systems that handle the enterprise’s critical data

- Implement security policies to limit access to systems

- Report and analyze all traffic that does not match rules

Achieve regulatory compliance

- Map dependencies of in-scope applications

- Protect regulated applications with granular segmentation policies

- Monitor policy and connectivity for compliance violations

Enable digital transformation

- Visualize relationships between application components across the data center and cloud

- Secure applications consistently as they transform from on premises to cloud native

- Integrate with DevOps processes to automate security at scale